India’s open access market has the potential to offer 20GW of solar PV to power the country’s heavy industries, according to a report from think tank Ember.

Across the top five steel, cement and aluminium-producing states in the country, industries would have access to the 20GW solar PV under the green energy open access mode of power procurement.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This mechanism allows industrial consumers – above 100kW – to procure renewable energy directly from a renewable energy generator using the transmission and distribution infrastructure under a non-discriminatory open access framework.

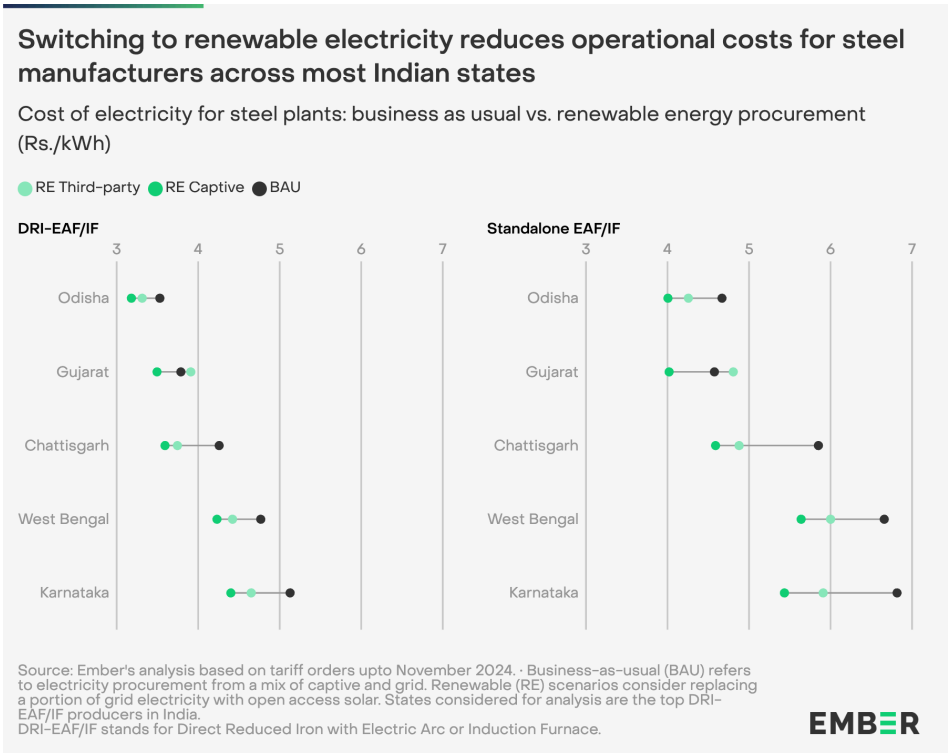

Steel would present the largest opportunity with 9.4GW of potential capacity, nearly half of the total capacity available, due to the industry’s greater reliance on expensive grid power, which can be replaced with open access solar. Not only that, steelmakers could reduce their productions costs by up to 10% – in the case of standalone electric arc furnaces – by using solar PV generation.

Moreover, two states – Odisha and Chhattisgarh – acccount for nearly 40% of the 20GW of open access solar power opportunity, as they have both served as core industrial hubs for the country’s steel and aluminium production.

“States such as Odisha and Chhattisgarh have long been legacy industrial hubs, owing to their proximity to rich mineral reserves. By integrating renewable power, they are well-positioned to begin their transformation to green manufacturing hubs,” said Duttatreya Das, energy analyst for India at Ember.

“The shift is already in motion—Odisha is now actively envisioning green industrial parks, setting the stage for an export-driven, low-carbon future in manufacturing.”

According to Ember, recent waivers on open access charges have made renewable power more appealing in these regions and made it commercially viable sourcing option for these heavy industries. With the potential to shift these industries into green manufacturing hubs could have the potential to attract international climate finance and corporate investments too.

Ember’s report can be accessed here.

The cost of round-the-clock renewables

Another key takeaway from the report is that sourcing 50% of renewable energy for heavy industries is cost-effective today and is possible without the need to integrate energy storage into the mix. However, increasing the renewable energy penetration from 50% to 80% would lead to a 40% premium due to the cost of storage and the challenges of managing surplus electricity.

“Cost-competitive, near-24/7 renewable energy will power the first wave of industrial decarbonisation and redefine the future of corporate power purchases,” explained Neshwin Rodrigues, senior energy analyst for Asia at Ember.

The report highlights that reaching round-the-clock renewable energy would come at a premium of 3.5 times the cost of standalone renewable energy generation. Once again, battery deployment would drive up system costs as Ember forecasts the technology would contribute up to 60% of the total cost of sourcing 24/7 renewable energy.